One Stop Service for Foreign Investment in Bangladesh

Foreign investment services offered by KMS typically help individuals or businesses invest in markets outside their home country. These services can vary widely depending on the firm, the client’s needs, and the regulatory landscape. Bangladesh is a growing market in South Asia, with a strategic location, competitive labor costs, and a rapidly expanding economy. The government actively encourages Foreign Direct Investment (FDI) by offering various incentives, particularly in sectors like manufacturing, energy, ICT, and infrastructure.

Key Institutions Involved

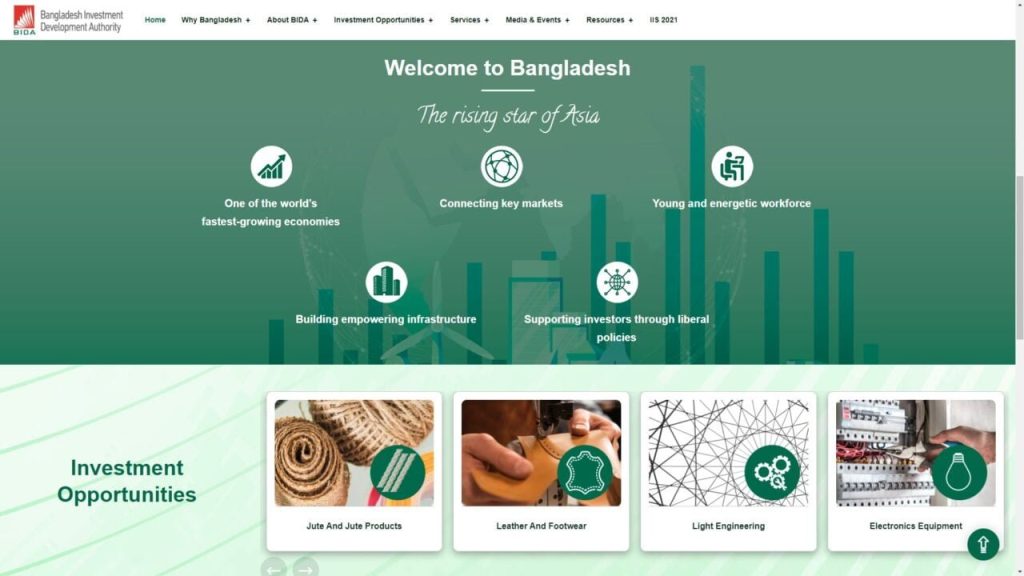

BIDA

One-stop services for FDI

Bangladesh Bank

Forex and repatriation oversight

RJSC

Company registration

BEZA/EPZ Authority

For zone-based investments

National Board of Revenue (NBR)

Tax and VAT matters

Legal & Regulatory Framework

Foreign investment is primarily governed by:

- Foreign Private Investment (Promotion and Protection) Act, 1980

- Companies Act, 1994

- Bangladesh Investment Development Authority (BIDA) Act, 2016

- Export Processing Zones (EPZ) & Economic Zones Acts

- Bangladesh Bank regulations (for remittances, repatriation, etc.)

Key Benefits for Foreign Investors

- 100% foreign ownership allowed in most sectors.

- Repatriation of profits, capital, and dividends is permitted.

- Tax holidays and duty-free import of capital machinery.

- Special Economic Zones (SEZs) and Export Processing Zones (EPZs).

- Access to regional markets (SAARC, ASEAN).

- Double taxation avoidance agreements (DTAAs) with several countries.

Procedures for Foreign Investment

1. Choosing a Business Structure

- Private Limited Company (most common for foreign investors)

- Branch Office

- Liaison Office / Representative Office

- Joint Venture with a local partner

- All entities must be registered with the Registrar of Joint Stock Companies and Firms (RJSC).

2. Company Registration (via RJSC)

- Name clearance

- Drafting MOA (Memorandum of Association) & AOA (Articles)

- Submission of registration documents

- Obtaining incorporation certificate

3. Approval from BIDA (if required)

- Apply to Bangladesh Investment Development Authority for:

- Industrial projects

- Branch or liaison office permissions

- Work permits for foreign nationals

- Submit a detailed investment proposal/business plan

- BIDA issues registration certificate or approval letter

4. Opening a Bank Account

- Open a Temporary Foreign Currency Account to bring in capital

- Deposit inward remittances via TT/SWIFT

- Bank forwards documentation to Bangladesh Bank for reporting

5. Obtaining Other Licenses (if applicable)

Depending on the industry:

- Trade License (from City Corporation)

- VAT Registration (from NBR)

- Import/Export Registration Certificate (IRC/ERC)

- Environmental Clearance (for manufacturing)

- EPZ/SEZ registration (if operating in those zones)

6. Remittance & Repatriation

- Profits/dividends can be fully repatriated through formal channels

- Requires Bangladesh Bank clearance and proper documentation